In recent decades, two retail giants have risen to dominate both online and offline sales: Amazon and Walmart. These two powerhouses have pursued aggressive yet different revenue strategies to fuel their rapid growth and expand their market share.

While Walmart focuses on operational efficiency, working capital management, and omnichannel sales, Amazon prioritizes rapid growth by reinvesting revenue into expansion and new markets.

Their intense competition is transforming the retail landscape, setting trends that other retailers must respond to while also risking market saturation.

By examining in detail how each company approaches expansion, technology, working capital management, and more, we can understand their transformative impact on the future of retail.

Amazon’s Revenue Strategy: Growth Above All Else

As an online marketplace founded in 1994, Amazon prioritizes rapid revenue growth and expansion into new markets above all else.

Initially focused on books, Amazon has diversified into clothing, electronics, groceries, web services, and more – anything to keep sales climbing year after year.

While critics argue this laser focus on growth has come at the expense of consistent profitability, Amazon plows all revenue back into infrastructure and acquisitions like the $13.7 billion purchase of Whole Foods Market in 2017.

This has allowed Amazon to expand its physical footprint while breaking into grocery retail, all financed through the negative cash conversion cycle exemplified by Amazon’s strategy.

Rather than earn profit from sales, Amazon’s model is dependent upon increasing cash flow to enable further expansion.

By delaying payments to suppliers and retail partners while encouraging customers to pay upfront for Amazon Prime subscriptions, Amazon creates a negative cash cycle ultimately funded by accounts payable.

Any incoming payments are immediately reinvested to open more fulfillment centers, develop new technologies, or acquire competitors like Audible and Zappos. As a result, free cash flow has soared in recent years despite a lack of profit, funding larger investments to drive growth.

Walmart’s Revenue Strategy: Operational Efficiency Is King

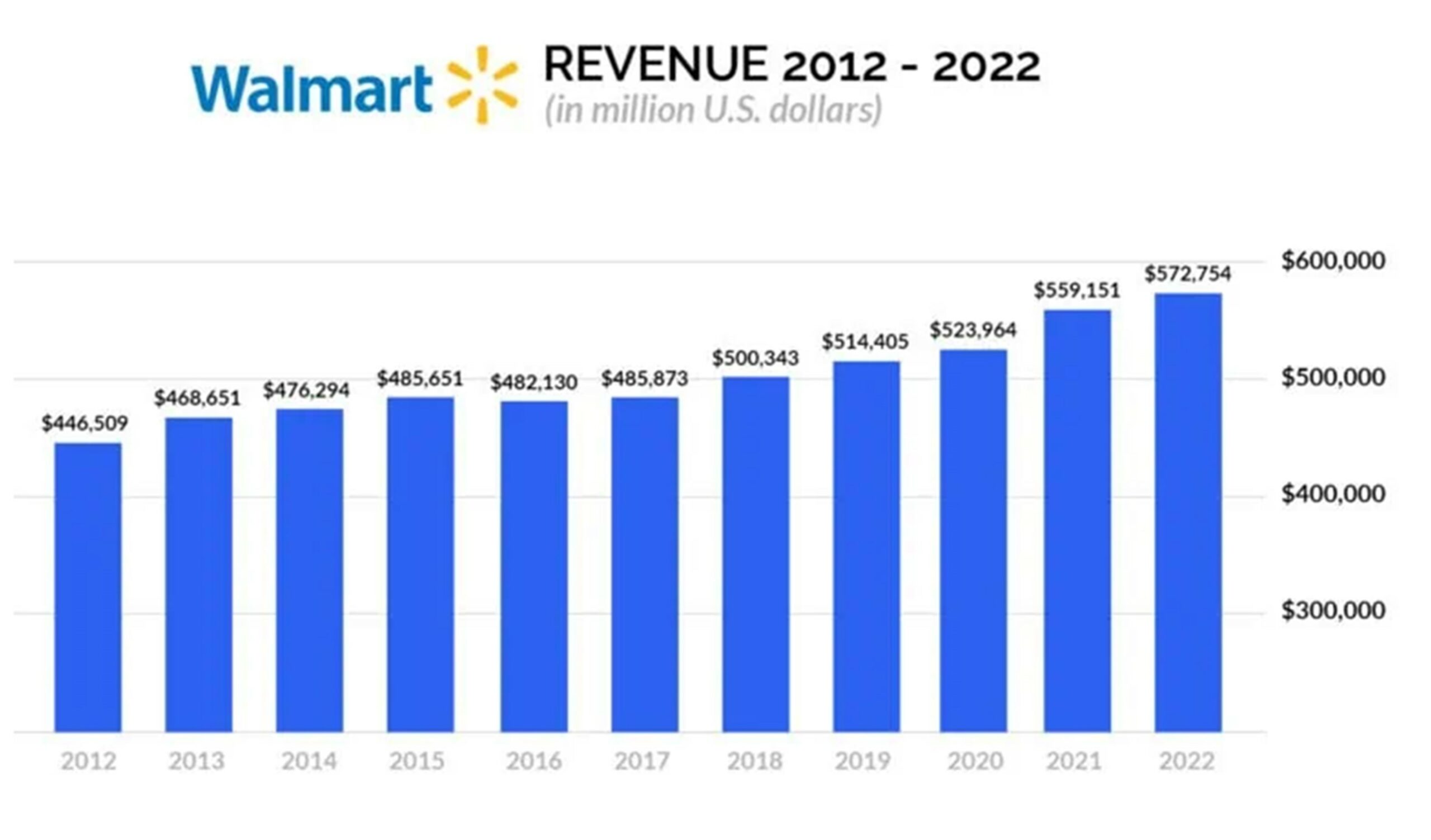

In contrast, Walmart built an empire in brick-and-mortar retail long before venturing into e-commerce. Founded in 1962 by Sam Walton, Walmart now earns over $500 billion in annual revenue and was ranked #1 on the Fortune 500 list for 8 consecutive years.

However, traditional retail faces declining foot traffic and thin profit margins, especially with competitors like Amazon undercutting prices online.

In response, Walmart has poured resources into building robust online sales channels while defending in-person visits by focusing on operational efficiency rather than chasing runaway growth like Amazon.

The key to Walmart’s strategy is managing working capital needs to reduce costs. By meticulously overseeing inventory levels, collecting payments quickly, and stretching accounts payable, Walmart creates strong cash flow from short-term assets and liabilities required for day-to-day operations.

This allows Walmart to self-fund expansion, freeing them from relying on outside financing. In addition, by keeping selling, general & administrative expenses low, Walmart earns far higher profit margins from each sale compared to Amazon.

Though online channels make up just 11% of Walmart’s total sales, they’re growing rapidly as Walmart shifts focus to omnichannel retail.

Key Metric Comparison: Negative Cash Cycles vs. Low DSO

To compare these divergent approaches, let’s examine key metrics starting with cash cycles. Amazon’s negative cash cycle averaged -31 days in 2021 compared to Walmart’s more traditional cycle of 1 day.

Amazon extends accounts payable to 73 days on average before paying suppliers and partners, using this float to finance operations. Walmart pays suppliers faster at 40 days but uses inventory management to reduce overall working capital needs.

This is reflected in Walmart’s day’s sales of inventory (DSI) of just 40 days, demonstrating extreme efficiency.

Meanwhile, both companies try incentivizing customers to pay upfront for subscription programs like Amazon Prime and Walmart+, which deliver revenue today that can fund tomorrow’s growth.

Amazon Prime boasts 200 million members globally while Walmart+ recently reached 11 million US subscribers, proving these programs’ value in accelerating cash flow.

However, Walmart collects payments from non-subscription customers faster with days sales outstanding (DSO) of just 5 days compared to Amazon’s 14 days. Overall, Walmart simply operates with far less capital requirements through disciplined efficiency.

In terms of growth, Amazon has been printing money with a staggering 140% 5-year revenue growth rate, closing in on Walmart’s superior size. Walmart’s revenue has only grown 17% over that same period.

However, Walmart maintains a commanding lead controlling 6.8% of total US retail market share in 2022 compared to Amazon’s 6.1% share. Though growth has slowed, Walmart’s efficiency has helped defend its in-person retail dominance.

But Amazon increasingly squeezes the market, especially online where it owns 41.4% of US e-commerce sales.

Impact on the Retail Industry: For Better and Worse

This intense battle is transforming retail in both positive and negative ways. Both Amazon and Walmart have proven masters at anticipating consumer demand and adapting product offerings to capitalize on new trends.

Competitors must follow their lead investing heavily in online sales channels while streamlining physical stores for omnichannel success. The retail workforce is also undergoing major changes.

Walmart employs over 1.6 million US workers and remains a source of stable, lower-wage jobs, while Amazon offers salaries 30% higher on average but has faced criticism over grueling working conditions for warehouse staff and delivery drivers as it strains to keep up with demand.

Both have additionally seen employee walkouts and unionization efforts gaining steam in recent years, though Amazon in particular has been accused of illegal retaliation against activist workers.

For customers, the convenience and choice offered by these retail giants is unmatched. But their size also allows anti-competitive practices like undercutting prices at a loss to choke competitors while using captured market data on best-selling items to develop private-label consumer goods.

Both Amazon and Walmart then promote their own generic brands ahead of small sellers and vendors. This level of market control has drawn antitrust scrutiny from regulators and policymakers worried about monopolization in retail.

Still, these companies succeed because consumers vote with their wallets. The lower prices and greater efficiency they drive serve us even as we must consider the potential downsides of market domination by two players increasingly controlling what we buy.